Final Tax Bite

This calculator estimates your estate's tax liability at death with no surviving partner.| Alberta |

| Regular taxable income in year of death |

50,000

|

| Estate Assets | |

| These are considered to have been sold for fair market value immediately prior to death. | |

|

Market Value |

Original Cost |

Capital Gain |

Taxable Amount |

|

| RRSPs |

100,000

|

N/A

|

N/A

|

$0

|

| RRIFs |

0

|

N/A

|

N/A

|

$0

|

| DPSPs |

0

|

N/A

|

N/A

|

$0

|

| Total registered |

$0

|

N/A

|

N/A

|

$0

|

Taxes on Your Estate

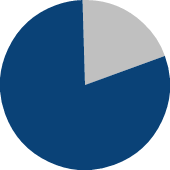

| Pay taxes of: | $29,551 | 8.0% | |

| Estate keeps: | $340,449 | 92.0% | |

| Total estate: | $370,000 | 100.0% |

Assumptions

This calculator is for illustration purposes only and is not intended to calculate your actual tax liability. It provides an estimate of the tax liabilities at death assuming there is no surviving spouse.

Calculations use marginal tax rates as of . Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The capital gains inclusion rate is 50.00% on capital gains up to $250,000 and 66.67% on capital gains above $250,000.

Only Canadian assets are included in the calculations. The tax on your estate is the difference between the tax payable on your regular income (before any deemed dispositions of your estate's assets) and the tax payable on your regular income plus the taxable amount of your estate.

Disclaimer

This calculator is for illustration purposes only and is not intended to calculate your actual tax liability. It provides an estimate of the tax liabilities at death assuming there is no surviving spouse.

Calculations use marginal tax rates as of . Rates take all federal and provincial taxes and surtaxes into account and the basic personal tax credit. The capital gains inclusion rate is 50.00% on capital gains up to $250,000 and 66.67% on capital gains above $250,000.

| Capital Gain | Inclusion Rate | Taxable Gain | |

| First $250,000 | 50.00% | ||

| Above $250,000 | 66.67% | ||

| Total |

Only Canadian assets are included in the calculations. The tax on your estate is the difference between the tax payable on your regular income (before any deemed dispositions of your estate's assets) and the tax payable on your regular income plus the taxable amount of your estate.

| Taxable Amt | Tax | ||

| Regular + estate income | A | $378,000 | $147,451 |

| Regular income | B | $50,000 | $8,883 |

| Estate income | A-B | $328,000 | $138,658 |

Disclaimer